Explainer: the three Swiss pension pillars

The Swiss cabinet and parliament are wrangling over reforms to the country's pension scheme. How does the current system work?

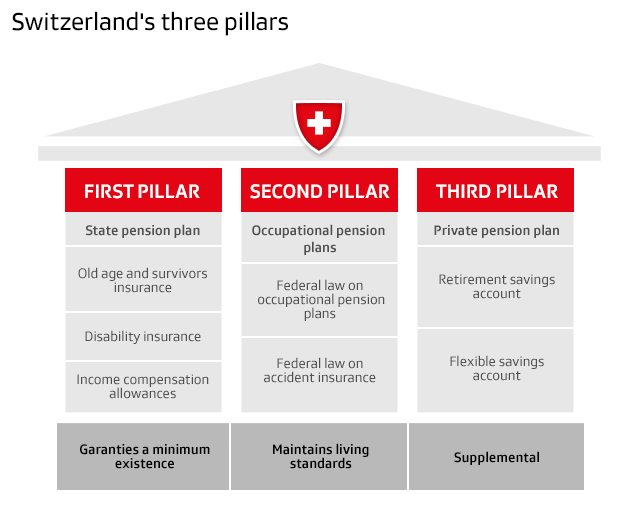

The first is a state pension plan that consists of various insurance schemes such as the (OASI), Disability Insurance, and Unemployment Insurance. OASI and disability insurance are mandatory for all Swiss residents.

Men, at 65, and women, at 64, are entitled to an old-age pension. Payments may be started earlier by one or two years, but a fee is charged per year advanced. Payments can also be postponed by one to five years, which gives an increase in payments depending on the number of months postponed. In some cases, beneficiaries of old-age pensions can get a pension for a child and/or for their spouse.

The second pillar is based on occupational pension plans and accident insurance. Employees who earn more than CHF21,150 a year are automatically insured by a second pillar pension fund. Pension plans and accident insurance have been mandatory for all employees for more than 25 years. The self-employed can join on a voluntary basis. When combined with the first pillar benefits, a person could expect to earn about 60% of their final salary after retirement to help maintain their standard of living.

The third pillar is a private, individual option that workers can use to help make up the remainder of their income not covered by the first two pillars. Such schemes are also protected by law and often offer tax advantages. These typically take the form of a retirement savings account (with tax breaks) or a flexible savings account (few if any tax breaks).

But since Swiss society like those of many western countries is ageing, more people are entering retirement and depending on their pension longer while there are fewer people of working age paying into the sytem.

Parliament is currently discussing reforms, including a plan to increase the retirement age of women from 64 to 65, and to reduce the conversion rate used to calculate the pension payout from the occupational pillar.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.