More questions than answers to finance crisis

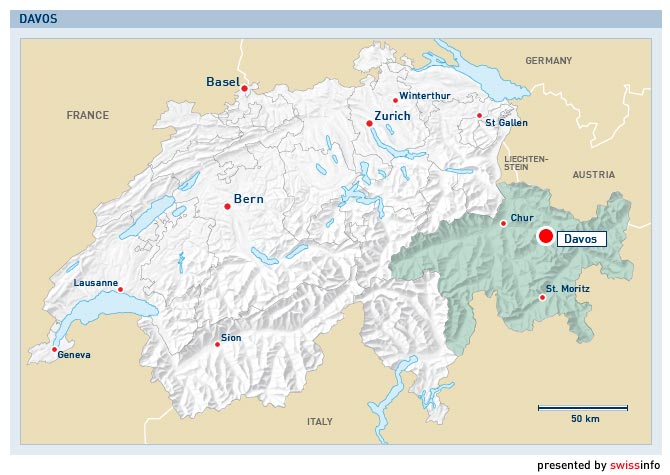

Finding a solution in Davos to the global financial crisis appears a distant prospect, judging from a World Economic Forum debate involving key Swiss experts.

Bankers, politicians and professors traded verbal blows in the southeastern Swiss resort and found little common ground to the question of how to fix the ailing sector that crashed so spectacularly last year.

Suggestions ranged from regulating each new financial instrument on the market to introducing virtually no new rules at all. But a panel agreed that banks should shift their ideology from short-term profit making to long-term sustainability.

Swiss National Bank President Jean-Pierre Roth took issue with the debate opening on the question of bonuses.

The Swiss banking regulatory body this week agreed that UBS, Switzerland’s largest bank, could pay out SFr2 billion ($1.77 billion) in performance-related pay – a decision met with widespread dismay.

“If we want to learn the lessons then we should set aside emotions and study the problems rationally,” Roth retorted. “If you look closely then you will see that some sectors of the bank performed well. Why should you cut the rewards of people who have met their targets?”

However, Professor Peter Ulrich of the Institute for Business Ethics at St Gallen University said the decision would further damage trust in banks and call into question the independence of the newly revamped regulatory body.

Radical regulations

Ulrich called on the state to introduce a radical set of regulations to prevent the sort of uncontrolled excesses recently witnessed in the banking sector from happening again.

“There should be an obligation to obtain authorisation from the state for new financial products in the same way as drugs or medicines,” he said.

Former Swiss price regulator Rudolf Strahm argued that banks should be obliged to put aside more money as a safety net against market shocks.

“The banks speculated too much with other people’s money without having enough reserves from their own equity. It is not the possible for the state to avoid fluctuations in the capital market, but it can insist on more equity capital to compensate for this,” he told swissinfo.

Banking regulators have already started this process, but Ivan Pictet, senior managing partner at the private Bank Pictet, argued against enforcing this requirement too strictly. Banks would have to liquidate 40 per cent of their assets to double their cash safety net, he argued.

“That would lead to enormous problems,” he said. “The real issue is having trust that the system works. Heaping lots of new regulations on the system would be counter-productive in this sense.”

Short-termism

Panellists also disagreed on the future impact of the financial crisis on the Swiss economy. Strahm said the problems encountered so far represented the “tip of the iceberg” and predicted massive job losses and pension fund shortfalls.

But Roth dismissed the comments as “too pessimistic”, arguing that Switzerland is much better placed than most economies to absorb the difficult conditions.

However, bankers Roth and Pictet agreed with other panellists that the financial community should change its approach to business in future. Roth admitted that bankers had failed to adequately assess the risk of their investments.

“Many of our problems derived from short term thinking. We have to go back to taking a long-term view on sustainability, the business model and the activities of our banks,” he told swissinfo.

swissinfo, Matthew Allen in Davos

The World Economic Forum started life as the European Management Forum in 1971. Formed by German-born businessman Professor Klaus Schwab, the forum was designed to connect European business leaders to their counterparts in the United States to find ways of boosting connections and solving problems.

It is a non-profit organisation with headquarters in Geneva that is funded by the varying subscription fees of its members.

The forum took its current name in 1987 as it broadened its horizons to provide a platform for finding solutions to international disputes. WEF claims to have helped calm disputes between Turkey and Greece, North and South Korea, East and West Germany and in South Africa during the apartheid regime.

WEF conducts detailed global and country specific reports and conducts other research for its members. It also hosts a number of annual meetings – the flagship being Davos at the beginning of each year.

In 2002, this meeting was moved to New York for a one-off change of venue to support the city following the 9/11 terrorist attacks of the previous year.

Davos has attracted a number of big names in the world of business, academia, politics and show business. These include: Nelson Mandela, Bill Clinton, Tony Blair, Bono, Angela Merkel, Bill Gates and Sharon Stone.

As the forum grew in size and status in the 1990s, it attracted rising criticism from anti-globalisation groups, complaining of elitism and self-interest among participants.

The 2009 WEF in Davos runs from January 28 to February 1.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.